Tuition Assistance

The 2025 Camp Levine Tuition Assistance application is now CLOSED.

For more information about Camp Levine tuition assistance please visit our website.

Levine Music is dedicated to providing quality music education for all students no matter their ability or financial circumstances. Through the tuition assistance program, we’re able to make music education an accessible option in our community by providing financial support for those who qualify.

Financial assistance is entirely need-based; award decisions are based on a family’s financial need and Levine’s ability to support a percentage of that need. Levine intends to offer aid to every eligible student who qualifies. However, it is common for the financial need of the community to exceed the organization’s available resources. In such instances, eligible applicants will be placed on a waitlist.

Levine complies in all its activities, programs, and policies, with all applicable laws and regulations prohibiting discrimination on any basis protected by law.

Eligibility

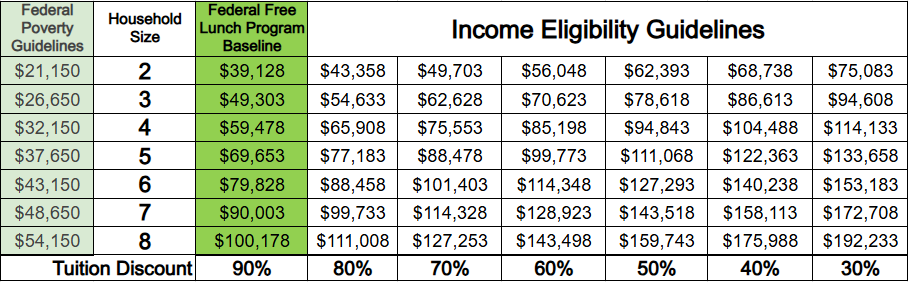

2025-26 Academic Year Scale for School-Aged Students

How does the sliding scale work?

1.Determine your household size. Your household size includes all adults and children who are listed on your Federal Income Tax Return, as well as anyone who is not listed on your tax return but resides in your home.

-

- If there is an adult in your household who is not a dependent, documentation that supports any income they receive (where applicable) must be submitted with your application.

Example: mom, dad, two children are listed on the tax return and Grandma resides in the home but is not listed on the tax return = 5

2. Determine your household income. Your household income includes incomes earned by all adults in the household. Please note that if you are currently married and file separately, you must include total income for you and your spouse.

Example: For three adults residing in the same household, you will add each individual income: $32,500 + $39,000 + $4,000 = $75,500

3. Find your household size and follow that line across the grid until you find the bracket your annual household income falls in; at the bottom of that column, you will find the maximum potential reduction.

Example: family of five, with a household income of $75,500 may be eligible for as much as 70% tuition reduction.

The Application

Documents You Will Need

The following are appropriate supporting documents that should be submitted (where applicable):

- All pages of your current Federal Income Tax Return (Form 1040, 1040-A, or 1040-EZ). Page 1 must be signed and include e-filing pin or tax preparer signature

- If you have not yet filed your current Federal Income Tax Return, please provide your most recent Federal Income Tax Return AND a copy of your most recent W-2 or 1099 forms.

- Current SNAP benefits (must show start & end date of benefits)

- Benefit letters or public assistance payments if you receive any allotment of monies from government agencies (ex. TANF, SNAP, Social Security, Child support, etc.)

- Teacher Recommendation Form (For Returning students only)

Decision Notification

All applicants will receive notice of their award status via email. Please be sure to provide a valid email address on your application.

What types of classes are eligible?

Students may request tuition assistance support for one course offering per academic year or summer semester, including private instruction or group classes.

- Awards are granted for up to 60 minute lessons for private instruction.

- All recipients are expected to enroll for the full academic year, unless otherwise approved by Levine. A student who withdraws prior to the completion of the school term will not receive credit on their award for subsequent enrollment. Awards are non-transferable and must be used during the term for which they are awarded.

What is the family's responsibility?

If approved, a decision notice is provided that outlines fees and requirements that must be fulfulled to remain in the Tuition Assistance program. All families pay some portion of tuition and fees. Awards are need-based, and amounts vary based on the type of class or lesson a student is enrolled in.

How does Levine determine and announce awards?

Each application we receive is evaluated individually using Levine’s sliding scale (above). All the information you submit is reviewed by Levine, which makes the final determination at its sole discretion. Awards are also subject to Levine’s financial circumstances and the availability of funding.

All applicants will receive notice of their award status via email. Please be sure to provide a valid email address on your application.

Is tuition assistance available for expenses beyond tuition?

Tuition assistance may only be applied towards tuition costs and does not cover any additional school fees (processing fee, payment plan fee… etc.) Students may request information or recommendations regarding instrument rentals or purchase from Campus Staff or the appropriate Faculty Chair.

Can students apply for tuition assistance if they've already applied for the Honors & Rising Stars Program?

Yes, however, students must submit a separate application for tuition assistance.

I am a faculty member who would like to submit a recommendation on behalf of a student. How do I do that?

Please use the TEACHER RECOMMENDATION FORM to submit a recommendation for your student.

Join our Mailing List

To be notified about updates in the Tuition Assistance program please complete the form below. We will contact you with more information when it becomes available.

Need More Information?

If you have specific questions about an application you’ve submitted, please contact the Tuition Assistance Team directly at tuitionassistanceteam@levinemusic.org or by calling (202) 686-8000.